Everyone is familiar with what the 15th Amendment did- the one that allowed blacks to vote. The 17th Amendment is also decently important, as it sets forth the policy we have today that there are two senators allowed per state. But how about the 16th Amendment? It was never really covered in the textbook, so I thought it would be interesting to see how this Amendment came to fruition.

Why was this Amendment put into place?

In 1894, the Wilson-Gorman Tariff was implemented in which those earning over $4000 during that time were subject to a 2% tax. This tariff was heavily supported in the south, but heavily opposed in the West. The Farmer's Loan and Trust Company agreed to this tax, while also stating that its shareholders would also pay the tax. Charles Pollock, a shareholder, sued the company, refusing to pay the tax. He lost in the state courts but would eventually appeal to the Supreme Court. This would be known as Pollock v. Farmer's Loan and Trust Co. The Court eventually ruled in a landmark decision in favor of Pollock, stating that tax on income was treated as a direct tax, so it was unconstitutional. The constitution had previously stated that direct taxes had to be divided among the states by population, not income. The question of what was directly taxable made source of income very important.

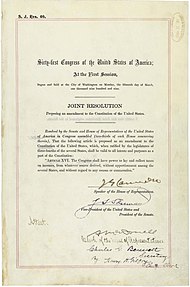

In 1909, Senator Norris Brown of Nebraska proposed the 16th Amendment of levying an income tax. Democrats and Progressives were for the tax, believing it was a better alternative to ineffective tariffs. By the 1912 election, the Republicans had been split due to the Roosevelt-Taft battle, clearing the way for the Democrats to control Congress. In February 1913, Congress announced that the 16th Amendment had been ratified by three-fourths of the states, thus making it an official Amendment.

So what does this Amendment explicitly state?

The legal provision states "Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration"

Basically, this means that Congress has the power to set income tax- taxes based on how much money a person makes. It got rid of the concept of direct taxes- that where the money came from determined how much one would be taxed, and instead made it plainly that how much one made would determine their taxes.

Aftermath of 16th Amendment

In the wake of the 16th Amendment, it effectively disproved the result of the Pollock case and legitimized the constitutionality of income taxes.

Overall, this Amendment was very important because it demonstrated the powers of congress and how it was able to curtail the power of big businesses, while also being a very effective way of raising revenue for the national government.

Today, the effect of the 16th Amendment is very evident. Every April 16th, people have to pay taxes which are normally about 50% of the income, much higher than the 2% when the tax was first proposed.

Sources:

https://www.law.cornell.edu/constitution/amendmentxvi

https://en.wikipedia.org/wiki/Sixteenth_Amendment_to_the_United_States_Constitution

This is a great blog post informing us of how the sixteenth amendment came to be and what it is. I feel like this might have made the common man upset a little because they were getting taxed more, but it also made them glad because now the wealthy also had to pay taxes. And since it was based on income the wealthy had to pay more.Since everyone had to pay taxes, the income tax showed that no one is above the unites states government. This tax also helps us today because with the taxes that people pay, things like infrastructure and education is funded.

ReplyDeleteInteresting post about the 16th amendment. I appreciate how you broke down the actual words of the amendment to make it clear, and I like how you chose to show how it affects us today. Income taxes are such a given in today's society, and it's intriguing to see where they originated from. It is strange that we don't cover it in class, as it seems to be such an important source of revenue for our country. After doing some research myself, I found that there is actually controversy over whether or not this amendment was actually ratified. The constitutionality of this amendment could be quite interesting to look into. For more information on the controversy, go to: https://en.wikipedia.org/wiki/Tax_protester_Sixteenth_Amendment_arguments

ReplyDelete